What is static and dynamic routing in payments?

Payment routing allows transactions to be routed through gateways with predefined parameters to make the processing of transactions faster and more efficient. This can be done through dynamic routing algorithms or static routing rules.

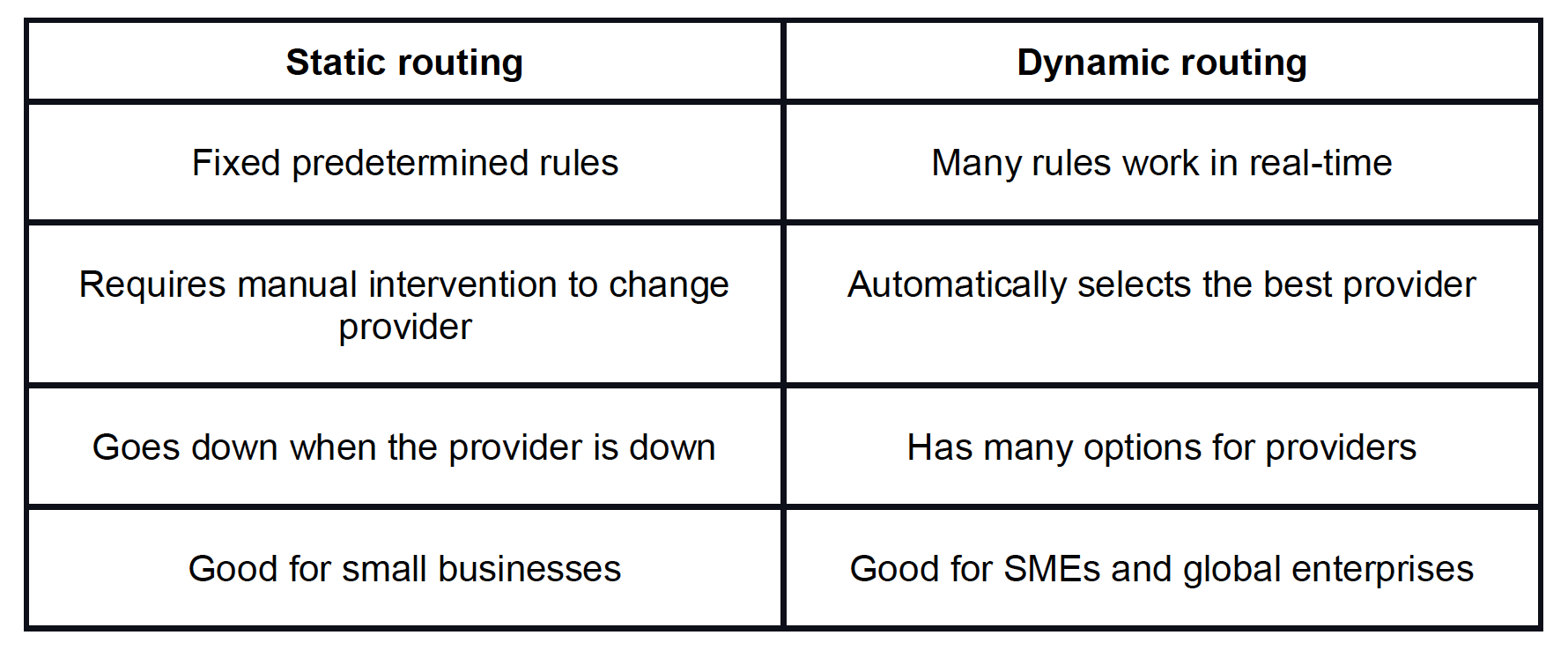

Although dynamic and static routing can route transactions, they have different advantages and disadvantages. Understanding the differences between dynamic and static routing will help you improve the efficiency of your payment system.

What is the difference between static and dynamic payment routing?

Although static routing is often considered outdated, it can be helpful when you need to implement strict rules and procedures for certain transactions. This option is also called rule-based routing. Although it is not as scalable as dynamic routing, it can be used when you need to maintain and update the rules.

Meanwhile, with dynamic routing, every transaction is routed to the appropriate provider, which can help to minimise the impact of issues on the other side of the business. You can ensure that your customers receive a seamless and consistent experience with dynamic routing.

What are the advantages of dynamic over static payment routing?

The success rates of transactions are directly related to how they are routed. With dynamic routing, payments are routed through multiple payment service providers (PSPs) to ensure that they reach the best possible outcome. This method can also help to minimise losses caused by failures.

Dynamic routing eliminates many of the issues and limitations faced by payment providers. It can also improve the overall experience of your customers.

Although dynamic routing cannot prevent all transactions from failing, it can help to minimise the number of technical issues at the end of the process.

Having multiple providers using dynamic routing can help businesses avoid dealing with a lack of options when choosing a payment service provider.

With dynamic routing, networks can find the most appropriate route for each transaction, which can help speed up the approval process.

Dynamic routing considers all routes in real-time to determine their success rate. This method can also help improve conversion rates and provide up-to-date statistics for your business.

What is dynamic payment routing?

Dynamic payment routing is a method to allow algorithms to find the best destination to process payments according to the data gathered from the PSPs.

How does dynamic payment routing work?

Through a series of algorithms,dynamic routing can find the best route for each transaction to reach its destination. It can also allow data to travel through multiple paths to maximise efficiency and speed.

When to use dynamic payment routing

A multi-channel payment solution is ideal for small and medium-sized businesses and international enterprises because it seamlessly integrates with multiple payment service providers.

How to configure dynamic payment routing

You need several PSPs to give you destination options when implementing a dynamic routing. Then, you can create rules that allow you to make various decisions related to the data collected by your PSP.

What is static payment routing?

Static payment routing, or non-adaptive routing, is a type of routing that allows network administrators to define a route for traffic based on a single route or a preferred route. It saves time and provides better performance compared to dynamic routing. However, in most cases, administrators must manually modify the routes to accommodate changes in the network.

How static payment routing works

Static payment routing uses a predetermined set of rules to operate. The main disadvantage of static payment routing is that it prevents transaction processing if the predefined route is unavailable.

When to use static payment routing

For smaller businesses, static payment routing can be handy as it avoids the need for multiple paths to connect to an outside network. It can also provide security for certain types of traffic.

What is payment orchestration?

A payment orchestration system is a software package that allows businesses to manage the various aspects of their online transactions. It involves connecting multiple payment service providers and banks on a single platform.

A payment orchestration system aims to help merchants reduce their transaction processing time and improve efficiency. It can be beneficial for managing their various payment services and platforms within one platform.