Introducing a payment gateway might make the business ecosystem run even more smoothly, both for consumers and business owners. A payment gateway ensures secure transfers of payment information and is often equipped with additional features to prevent fraud. It is essential for both online and offline businesses, especially those that want to accept credit card payments.

What is a payment gateway?

A payment gateway basically acts as an intermediary between a merchant, the customer, and the customer's chosen financial institution or an acquirer. It is atechnology that records and transfers payment data from the customer to the relevant financial institution and then transfers the payment approval or decline back to the customer.

1. What is a payment gateway used for?

A payment gateway is essentially a service that reads financial information and ensures its validity to eventually transfer funds from a customer's account to a merchant's account.

For offline business, it usually comes in the form of software built into a point-of-sale (POS) system or an electronic-data-capture (EDC) machine that can process a cardholder's transaction. An online payment gateway is a cloud-based mechanism that relays a customer's payment to the merchant.

2. What is a payment gateway in e-commerce?

Providing payment gateways in e-commerce means customers will have more options to securely pay for their purchases. The technology distributes financial data to the necessary entities to authorize payments while ensuring the transfer of funds from the customer to the merchant.

a. Payment gateway integration in e-commerce

Payment gateway integration for e-commerce can be costly and it is advised to hire a professional web developer or work with a web development company, especially if the e-commerce service also comes with an application. This means it requires the addition of some basic and advanced features related to the payment to your mobile application. These include a database for storing credit card data, refund management modules, or channels for linking financial institutions to the app.

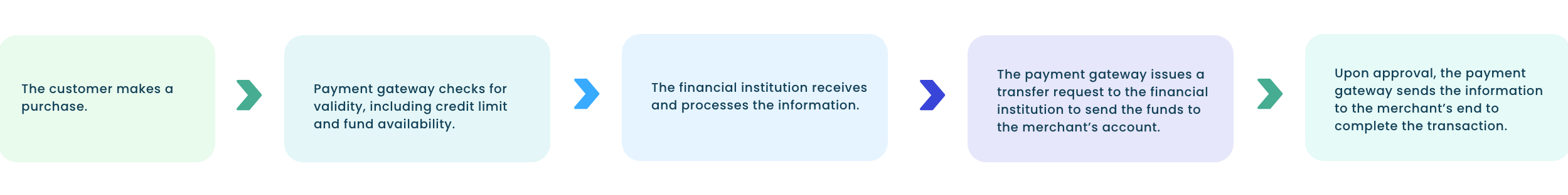

How does gateway payment work?

Essentially, a payment gateway is a type of service that records payment information upon completion of a transaction by customers when they use certain payment methods, such as credit cards. This information is then encrypted to be processed by a bank or other financial institution. Based on this information, the financial entity can decide to approve or decline a transaction. If it is approved, the entity will complete the settlement by deducting the value of the transaction from the customer's account and depositing it into the merchant's account after subtracting the payment processing fee.

1. How payment gateway works diagram

A payment gateway is a key component of the electronic payment processing system, as it is the front-end technology responsible for sending customer information to the merchant acquirer, where the transaction is then processed.

2. How do I set up a payment gateway?

It is possible to build your own payment gateway, but it might be too expensive and complicated. Instead, contact a trusted payment gateway provider and start your journey by completing a merchant application form. The form would require you to provide several documents, such as incorporation documents, utility bills, copies of passports, and bank statements.

After all the administration is completed, you can start integrating the payment gateway with your website. Some providers would provide the option to generate and redirect users to a hosted payment form or a code for you to embed the payment form instead.

Payment gateway process

1. Most-used mobile payment methods

Payment gateway technologies are constantly evolving, even contactless purchases are now available as many customers prefer to use their phones as payment devices instead of credit cards or debit cards.

In exchange, the use of mobile payment services has been increasing. In addition to existing giants such as Apple and Venmo, we now also have Zelle, Cash App, and Google Pay as some of the most-used payment methods. To keep up with demand, PayPal also bought Braintree in 2013 after purchasing Venmo the year before.

2. Requirements for payment gateway integration

The requirements to integrate a payment gateway will differ depending on whether it is an offline or online payment portal. While offline integration might need a POS terminal and internet connection, online integration will require application programming interfaces (APIs) that allow the website in question to communicate with the payment processing network, along with several other certifications.

In terms of administration, you will typically need an acceptable bank account for the region, a valid identity, a concise business plan, a website with clear terms and conditions of use, management accounts, as well as a profit and loss projection for the next six months at a minimum. Newer service providers such as Stripe would provide simpler means to register as they only ask for a bank account, email address, your account details, and some description of your business.

Types of payment gateways

1. Types of payment gateway integration

Integration is usually done by adding a payment page to the merchant's website. However, there are several types of integration that would ultimately affect the experience.

There are three main types of payment gateway integration. The first is redirect where the payment gateway simply takes a customer to a payment processor to process the transaction. Second is hosted or off-site payment where the payment information goes to the payment provider's servers for processing after the customer makes a purchase on your website or at your retail location. The opposite method is a self-hosted or on-site payment where the entire transaction happens on your servers.

If a merchant prefers to collect payment information and pass it to the payment gateway from their chosen type of payment page, their website must be able to establish a secure session via a communications protocol referred to as a secure sockets layer (SSL) that protects the payment details from unauthorized viewing. The merchant should purchase and maintain the validity of its SSL certificate.

2. What is the purpose of a payment gateway?

In card-not-present transactions, such as those performed online or through an app, the fraud risk is significantly higher. A payment gateway can act as the gatekeeper of a customer's payment data. On top of its benefits in terms of fraud risk management, a payment gateway also protects merchants from expired cards, insufficient funds, closed accounts, or credit limit excess.

3. Why is payment gateway integration important?

These days, very few people carry enough cash to make payments and many do their shopping online. The world has also started to recognise cryptocurrencies, prompting several blockchain startups to introduce payment gateway services in recent years.

A survey by SaleCycle showed some of the main reasons for cart abandonment may be related to the provision and quality of payment gateways. At least 15% of prospective buyers abandon the shopping cart for a better in-store experience, 6% due to a lack of payment options, and 4% due to technical issues.

Online payment gateway comparison

1. Examples of payment gateway

A payment gateway service may be provided by payment gateway service providers or banks. Large financial institutions such as Bank of America and JPMorgan Chase offer in-house services. Meanwhile, popular payment gateway providers include Square, Stripe, Apple Pay, and Amazon Pay.

2. Which is the best payment gateway?

The best payment gateway or payment service provider might be different for each type of business. When choosing a payment gateway or payment service provider, merchants need to consider its availability, reach, inclusivity, ease of use, and integration, as well as relevant features for their business. But security must be the key consideration. A provider must at the minimum comply with Level 1 of the Payment Card Industry Data Security Standard (PCI DSS) and offer built-in security capabilities, including fraud protection and prevention tools.

The simplest option is to opt for a well-known payment service provider such as PayPal, Stripe, or Square that handles the process all the way through with a proven record of security and integrity.

a. Online payment gateway comparison

PayPal is probably the most popular as a redirect payment gateway that offers fraud protection security without an additional charge. On the other hand, there is Square, a credit card processor and payment gateway provider famous for physical credit card swipers that attach to your phone that has been popular among small businesses in need of a method to process credit cards for in-person transactions.

Apple's payment gateway solution Apple Pay also aims at a mobile payment structure, enabling merchants to secure customer payments by using Face ID and Touch ID. Amazon Pay, another large player, has access to Amazon's more than 300 million customer accounts worldwide, making it very attractive as a payment gateway option, on top of an abundance of plugins.

Meanwhile, Stripe is a popular payment gateway provider with a broad focus on mobile e-commerce, software as a service, non-profits, and platform-based payments, such as Lyft. Accepting payments through a wide variety of processors, which in turn gives retailers the ability to accept PayPal payments, Apple Pay, and most major credit cards, is indeed crucial these days, and gateways such as Authorize.net recognize this.

Duality is also key, such as the approach taken by Adyen that was built for both POS and online purchases, accepting a broad range of payments from major credit cards and providers such as Apple Pay.

Payment gateway integration costs

1. How much does it cost to integrate a payment gateway?

Payment gateway costs depend on the providers. Some not only charge transaction fees but also monthly service fees, set-up fees, and additional fees for things such as chargebacks and cancellations.

2. What is a payment gateway fee?

Payment processing fees are the costs billed to merchants by payment gateway providers to process payments from customers. The size of these fees may be influenced by various factors, such as the level of risk of the transaction, type of card, or even the payment processor's pricing method.

For credit card payments, there are several additional factors, including interchange rates, merchant account provider fees, and the card processing method – such as card swiping, over-the-phone transactions, and online transactions, which all carry different levels of risk.

3. Payment gateway cost comparison

● PayPal: 2.9% processing fee with an additional $0.30 per transaction.PayPal's Payflow gateway includes the option of a $0/month checkout payment gateway hosted by PayPal, or a $25/month option with more checkout customisation features.

● Square's processing fees are currently 2.75% for swiped transactions and 3.5% + $0.15 per manually entered transaction.

● Stripe: 2.9% processing fee and $0.30 per transaction.

● Apple Pay: 3% processing fee with no additional fees for merchant accounts.

● Amazon Pay: 2.9% on domestic transactions and 3.9% on international transactions with an additional $0.30 per transaction.

● Authorize.net: 2.9% on transactions with an additional $0.30 per transaction for their "all-in-one" payment provider option.

Payment gateway providers

1. What is a payment gateway provider?

Payment service providers handle the process end-to-end so merchants do not have to deal with the complex scheme. Popular payment gateway companies include Stripe, PayPal, Square, andShopify. These four are especially popular with online merchants and include both a payment gateway and merchant account. Other popular options areAuthorize.net that was introduced by Visa,2Sell by Verifone,Payline by Pineapple Payments, andAdyen.

2. Payment gateway vs payment processor

Payment gateways and payment service providers are two distinct entities. A payment processor can transfer financial information between the issuing and acquiring banks to move money into the merchant's account. However, to communicate across and authorize the transaction, it needs a payment gateway that mainly interacts with merchants and their customers. Some payment service providers such as PayPal include both services, as well as a merchant account and other features to handle all aspects of a transaction.